Industrial development announcements are one way that economic development organizations track the results of business development efforts. Many organizations set annual goals for new investment and job creation, report the information to investors, and sometimes the goals are tied to employee bonuses. EDOs report announcements to state agencies who then report that information to organizations that name the “best state for business” and bestow other accolades.

The details within announcement data can reveal key industries driving growth, which states and regions are attracting the most investment, and when benchmarked with previous years, put the investment and job creation in historical context. It is important to remember that context matters; economically, geographically, and organizationally. Each organization has its own priorities (target clusters, occupations, and industry size) that are considered important to their community and the state they represent. Comparisons are still an important tool to understanding interstate and intrastate economic development trends.

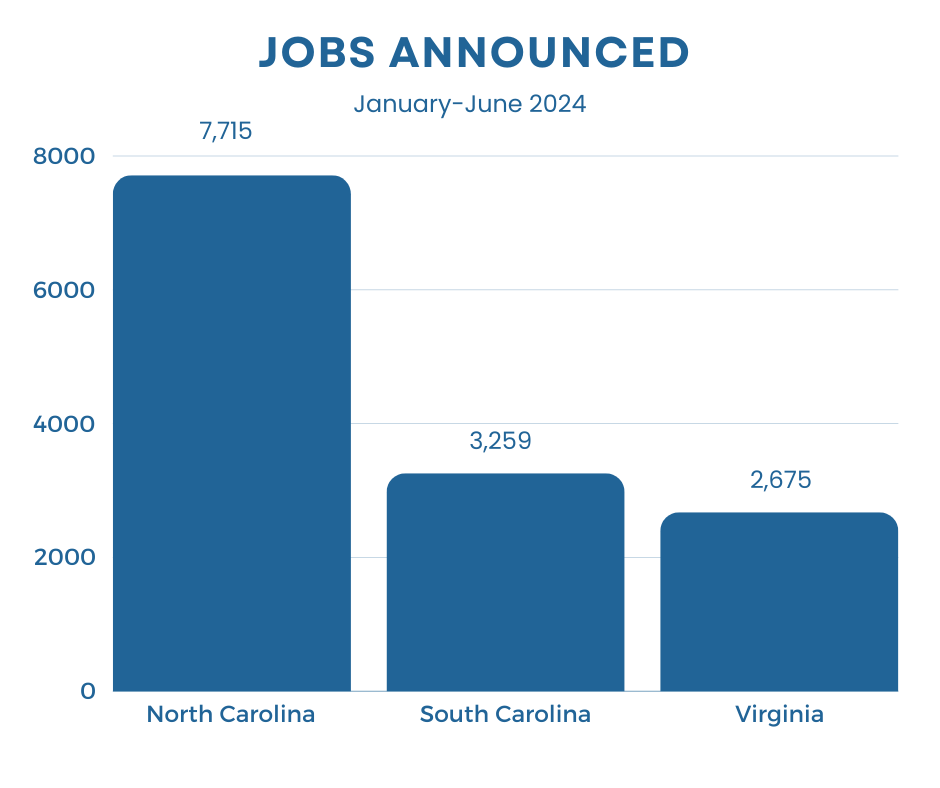

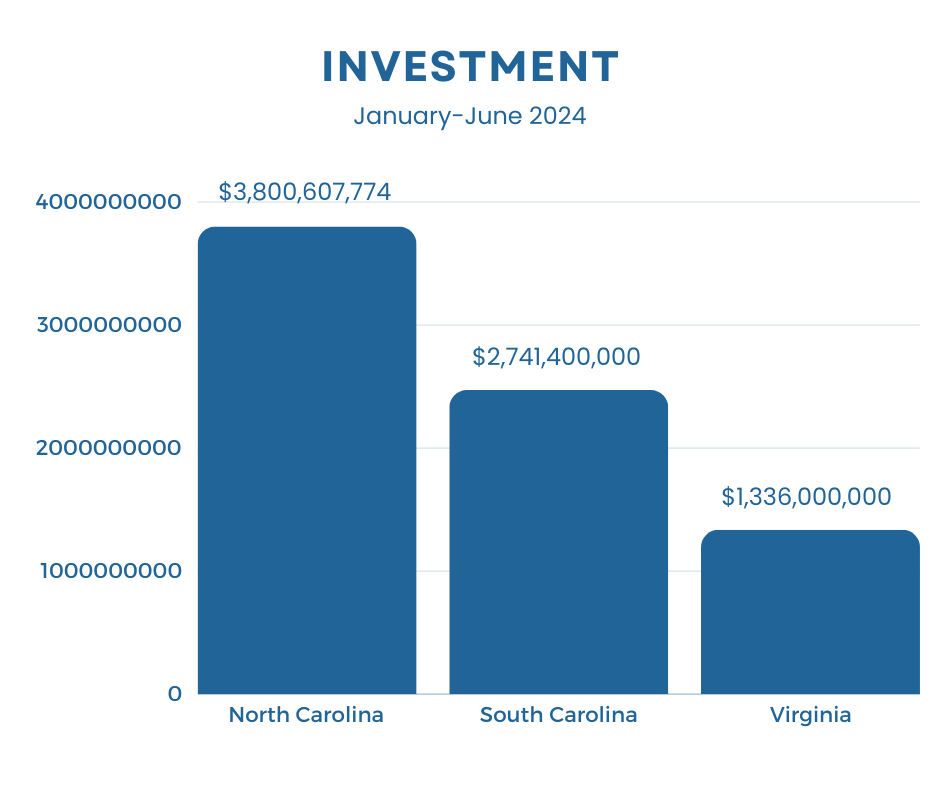

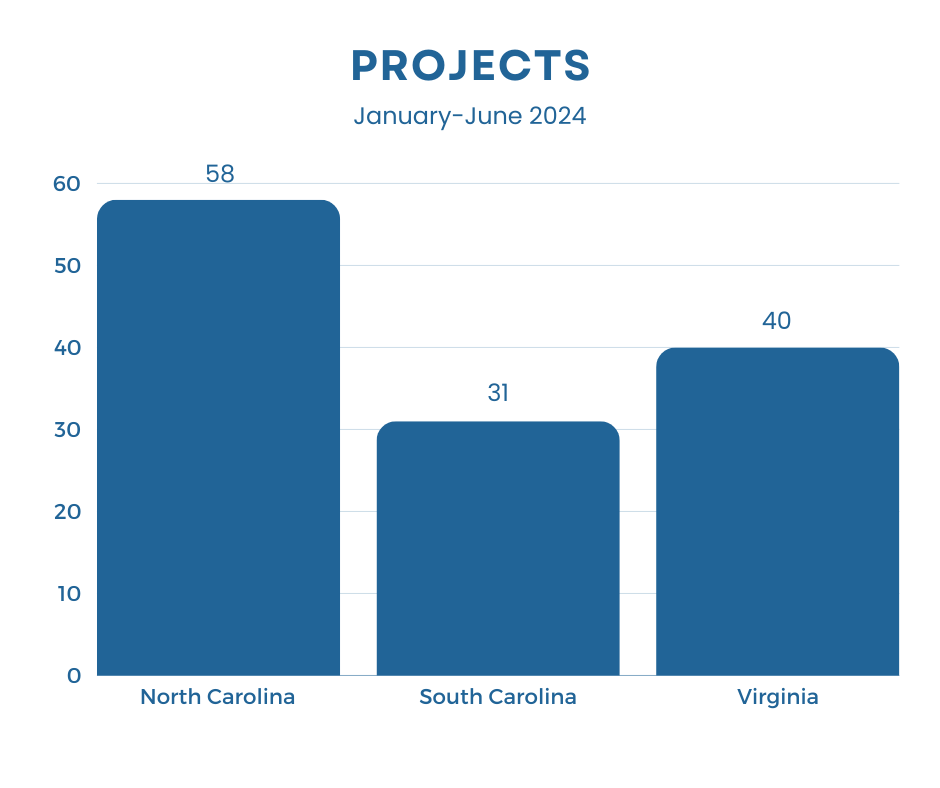

Now that we are midway through 2024, it is a good time to take stock of how things are going and spot trends. We analyzed data from NC, SC, and VA project announcement reports to see which state is leading at the halfway point in the year. The three main statistics that economic development organizations will track are projects announced, jobs created, and new capital investment. The relationship between them is correlative and not causative. However, the more projects that are announced usually means more jobs are created and more investments in capital.

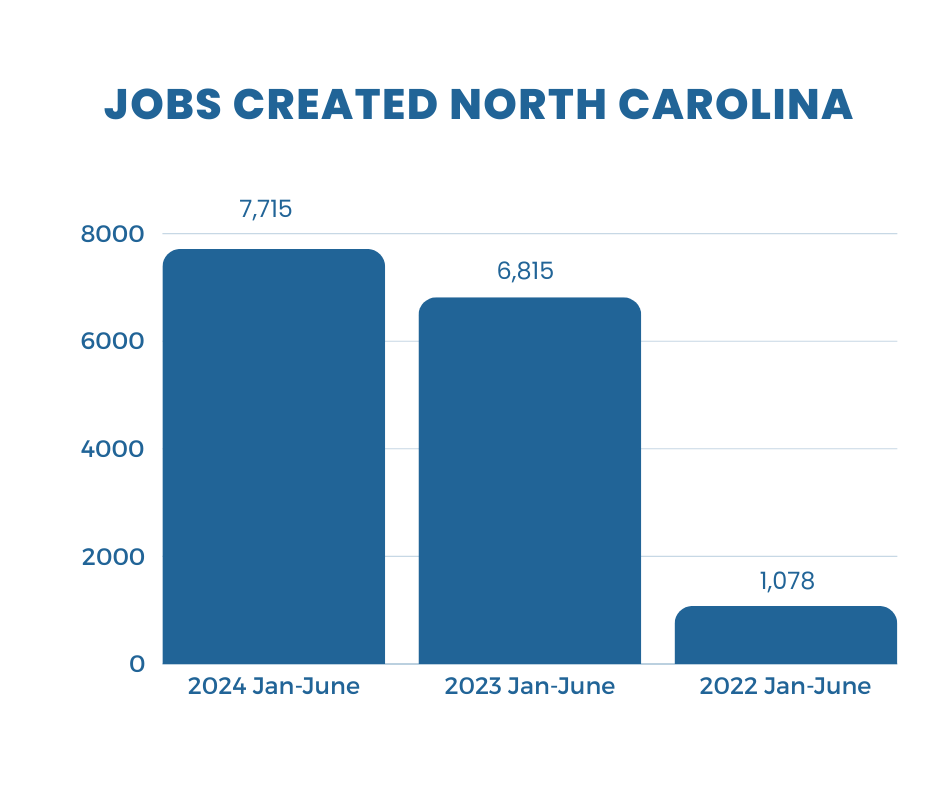

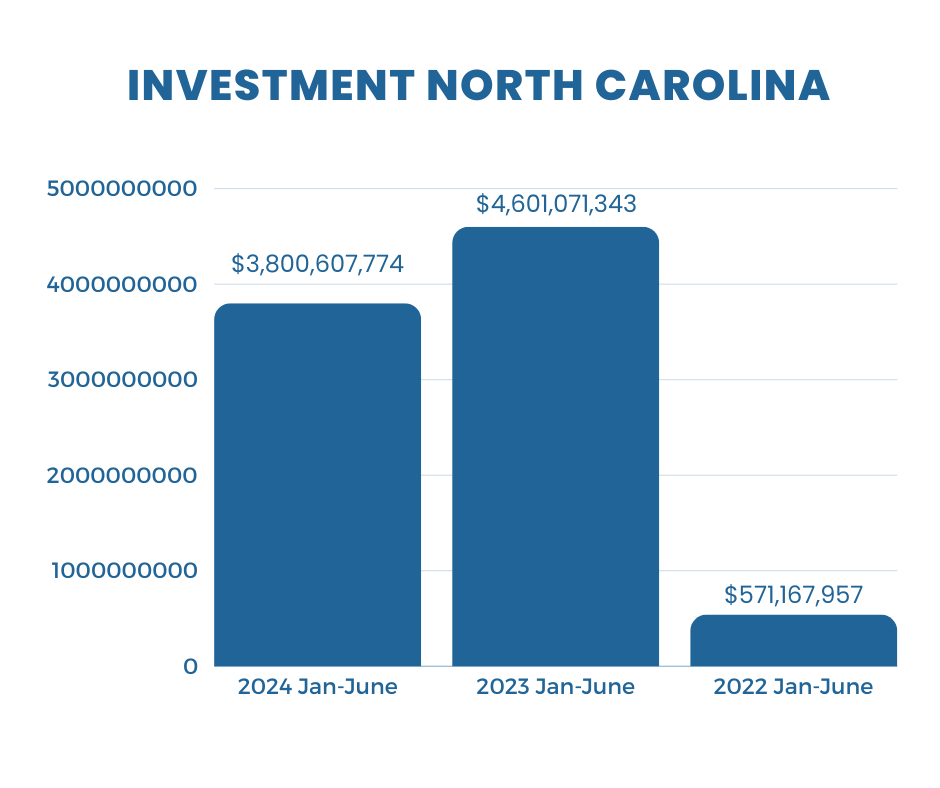

By June 30, 2024, North Carolina had announced 7,715 jobs created from 58 projects, an average of 133 jobs per project. Boviet Solar Technology in Pitt County created 908 of those jobs alone. The announced projects total $3.8 billion in investment; an average of $66 million per project. Almost one-third of total investment came from the Fujifilm Diosynth Biosynthetics, located in Wake County. Iredell and Gaston Counties tied for the most announcements in a locality at five projects each.

Relative to other years, North Carolina is in a good position as there are more mid-year jobs created than in 2023 and 2022, similar investment totals to 2023, and the state is on track to meet the same announcement total as 2023. According to recent data , more projects have been announced in the second half of each. If North Carolina can keep up the current pace, it’ll meet or exceed what was achieved in previous years.

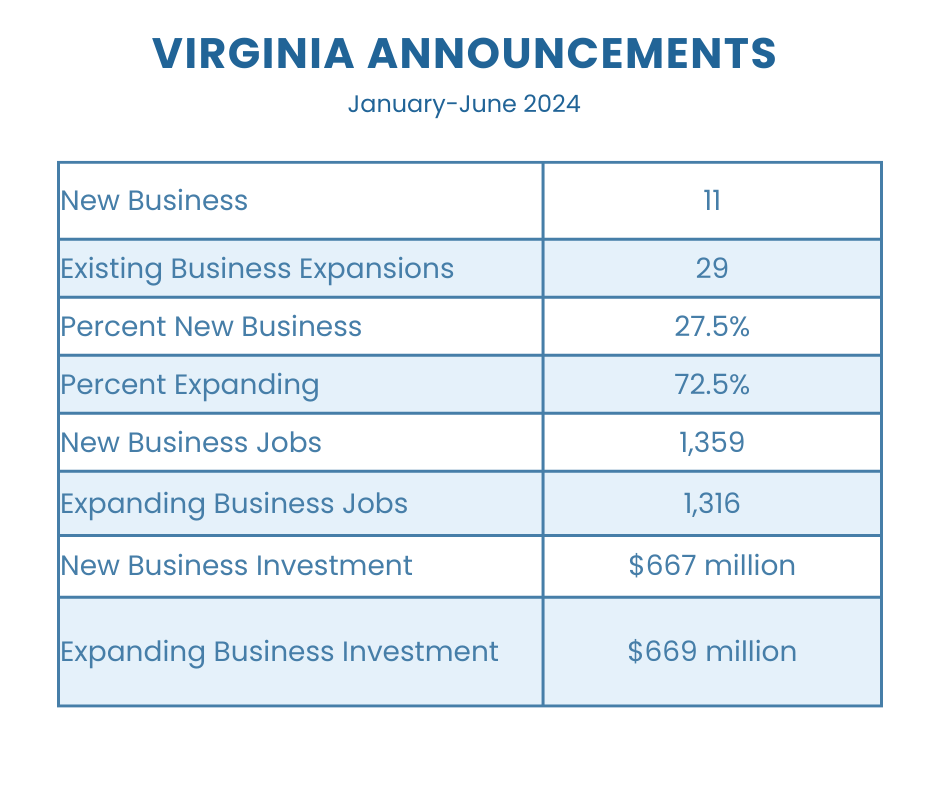

Virginia has announced 2,675 jobs in the first half of the year resulting from 40 projects, an average of 67 jobs per project. These projects announced $1.3 billion of investment, an average of $33 million invested per project. Topsoe in Chesterfield County accounts for almost a quarter of that total investment, and CoStar Group in Arlington is responsible for around a fourth of the jobs. Both companies are new to Virginia.

New business locations are important to the diversification of an economy; however, over half of all new jobs created and investment generated are typically from existing business expansions. Business retention and expansion (BRE) is foundational to a comprehensive economic development strategy.

South Carolina has announced 3,259 jobs created from 31 projects, an average of 114 per project. The announcements total $2.5 billion in investment, an average of $80 million per project. AESC Florence, LLC, is the single biggest contributor to both jobs and investment with 1,080 jobs and $1.5 billion in investment . The company is expanding its lithium-ion electric vehicle battery manufacturing operation in Florence County, in the Florence Industrial Park. South Carolina’s announcement information includes “grants awarded.” The 31 projects were awarded a total of $15 million in grants.

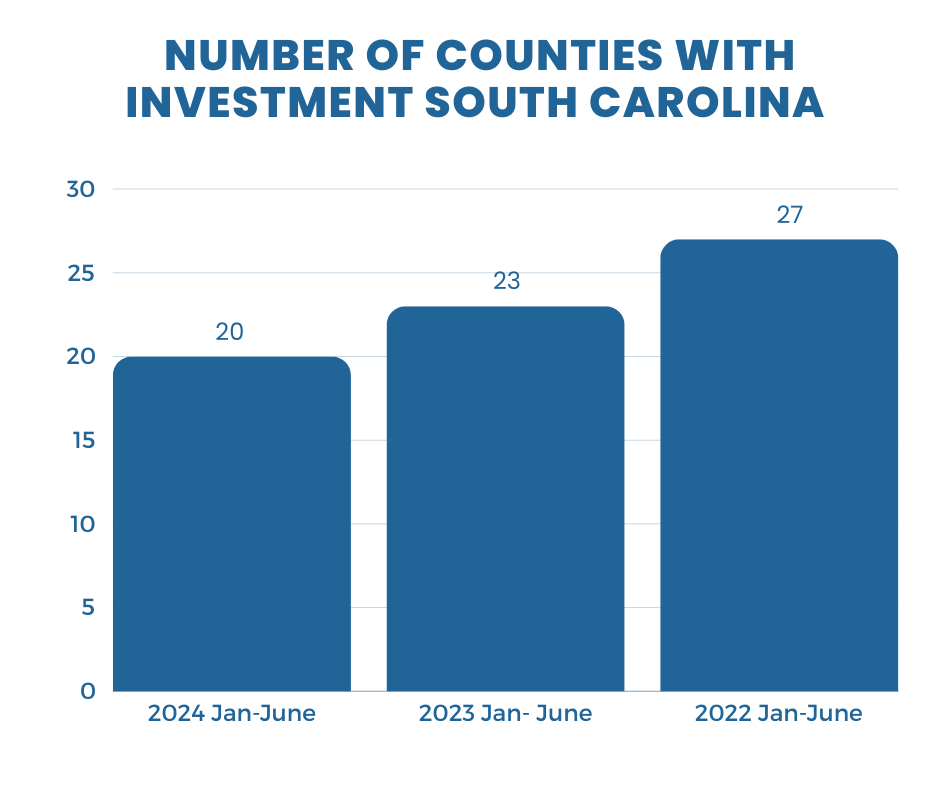

The projects are spread across the state. Nearly half of South Carolina’s 46 counties have had an announcement this year. Charleston County has the highest number of announcements at 5, and Oconee County has had four. However, over the last three years, the number of counties with announcements at mid-year has decreased.

At the 2024 mid-point, North Carolina has outperformed its two neighbors in number of announcements, jobs, and investment. North Carolina has 50% more announcements and investment and more than double the jobs announced in South Carolina. North Carolina has seen 31% more projects announced and almost triple the investment and jobs reported in Virginia. South Carolina had the largest single project announcement as measured by investment and jobs. Virginia has the greatest geographic diversity represented in its announcements. The 40 projects in Virginia were announced in 25 localities.

All three states are very competitive for economic development projects. In recent years, statewide agencies in North Carolina have placed a focus on developing new industrial sites. The state has also seen several large project announcements that are generating supply chain opportunities. South Carolina has, in recent years, had more product development programs than North Carolina and Virginia which gave it an advantage in business attraction. Virginia has been stepping up its game with new investments in talent and product development.

Sources

Economic Development Partnership of North Carolina (EDPNC) – CIR Database

Virginia Economic Development Partnership (VEDP) – Announcement Database

South Carolina Department of Commerce (SC DOC) – Project and Recruitment Data